“Blockchain” – is a new buzzword for many folks in finances. And on top of it, acronyms like DeFi and CeFi make us scratch our heads. Coming from a traditional finance sector I was in the same boat. So I started learning about this new technology that is boastfully showing its power to change the way financial institutions work. Let me take you through my understanding of what is Blockchain for us as accounting and finance professionals.

“Blockchain” – is a new buzzword for many folks in finances. And on top of it, acronyms like DeFi and CeFi make us scratch our heads. Coming from a traditional finance sector I was in the same boat. So I started learning about this new technology that is boastfully showing its power to change the way financial institutions work. Let me take you through my understanding of what is Blockchain for us as accounting and finance professionals.

Blockchain is gaining prime attention in many industries because of its strong decentralized network architecture which allows users to interact with financial services without the need for a middleman.

Before we dive deep into what DeFi is and what’s its importance and drawbacks for accounting professionals, Do we know what exactly is CeFi?

So, for better understanding let’s first briefly discuss – what CeFi is?

What is Centralized Finance (CeFi)?

Initially, crypto trades are controlled by the government and banks, where they list which coin to trade on, how much fees you need to pay and we have to adhere to their set of rules, which in nutshell is nothing but a centralized financial system.

Centralized finance or CeFi is a term used to describe the traditional financial system controlled by central authorities, such as banks and the government.

These traditional financial institutions control how money is managed and moved around.

This centralization can lead to a number of problems, such as corruption, high fees, and slow transaction times.

On the flip side is decentralized finance, which is an emerging financial system that is based on decentralized technologies, such as blockchain.

Some examples of CeFi companies and institutions are Binance, Coinbase, Kraken, and traditional banking institutions governed by private entities or governments.

Now we know what CeFi is, we are all set to gain more knowledge about decentralized financial systems.

What is Decentralized Finance (DeFi)?

DeFi (Decentralized Finance) is a term that describes the shift from traditional, centralized financial systems to decentralized ones.

It is an open-source decentralized platform that allows anyone to access financial services that are typically only available through central intermediaries like banks, brokers, and exchanges.

This paradigm shift in financial infrastructure has the potential to upend the traditional financial system and create a more inclusive financial system that is accessible to everyone.

DeFi platforms are already beginning to offer a wide range of services, including lending, borrowing, trading, and payments.

It allows users to take control of their finances and manage their money in a way that suits them, without relying on third-party financial institutions that ultimately eliminate the fees charged by banks and other financial institutions for their services.

In DeFi, you hold your money in a secure digital wallet instead of keeping it in a bank. This wallet is linked to your debit or credit card and you can use it to shop online or in-store, withdraw cash from an ATM, send money to friends and family, or pay bills.

A decentralized Financial system is built on the Ethereum blockchain. By using smart contracts, DeFi apps can automate financial transactions and run on a decentralized network of computers, making them more secure and resilient than traditional financial applications.

The rise of DeFi applications has led to the creation of a new breed of crypto assets, known as DeFi tokens, which are used to power the various DeFi protocols and applications.

With the rapid growth of the DeFi ecosystem, we are only beginning to scratch the surface of what is possible. The potential for DeFi is vast and we are excited to see what the future holds for this new era of blockchain technology.

TL;DR:

- DeFi allows for a more open, transparent, and accessible financial system that is not controlled by any central authority.

- It eliminates the fees of banks and other financial institutions that are usually charged for using their services.

- In DeFi, Funds are held in a digital wallet, unlike a bank account.

- While the potential for DeFi is huge, there are still many unknowns when it comes to its regulations.

Importance of DeFi for Accounting Professionals

Decentralized Finance (DeFi) plays a very vital role in the Finance Industry. It represents a new way of managing financial assets and liabilities.

DeFi has the potential to change the way financial transactions are conducted and recorded fundamentally, and as such, it is important for accounting professionals to be aware of and understand the principles and practices of DeFi.

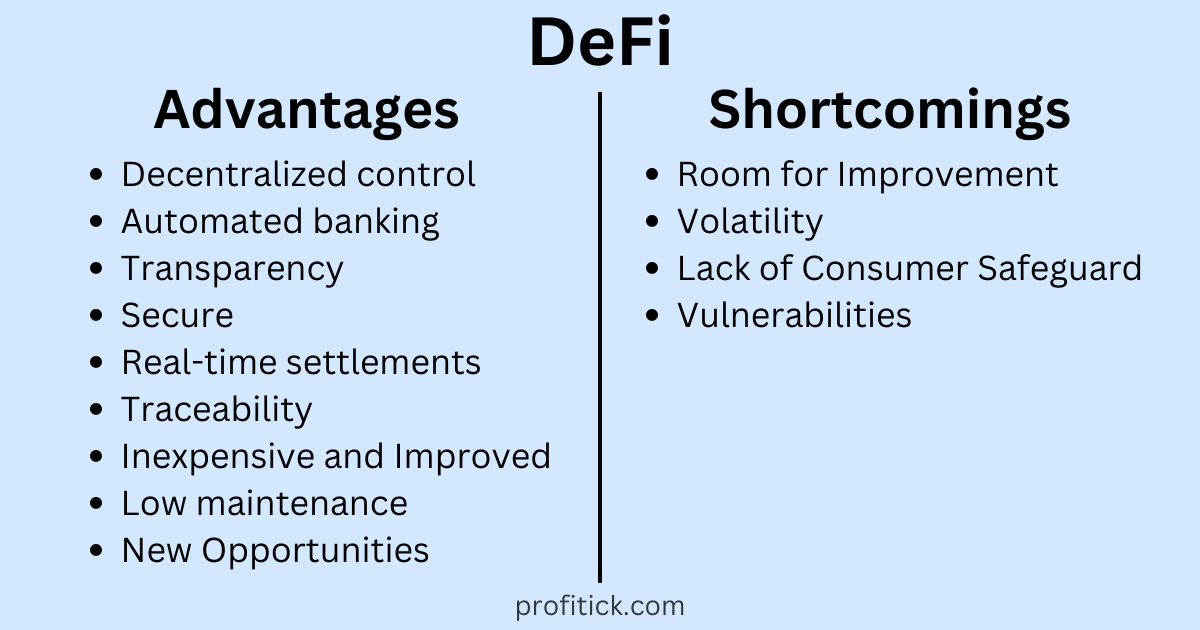

Decentralized finance protocols offer a number of advantages over traditional financial services, below is the list of them from an accounting professional’s perspective:

- Decentralized control: Everything in Public Domain

Blockchain technology has the potential to decrease fraudulent activities by providing a secure and transparent way to store and transfer data.

With the help of the Blockchain, accounting professionals can keep track of their data and transactions, making it more difficult for fraudsters to tamper with them.

- More automated banking for accountants than ever before

DeFi can help to decrease the workload of accountants by automating many of the tedious and time-consuming tasks that they would otherwise have to do manually.

This can free up their time so that they can focus on more important tasks or maybe invest their time in our never-ending tax issues.

- Transparency in the finances brings trust to the system

One of the key benefits of DeFi for accounting professionals is that it allows for greater transparency and accountability in financial transactions.

DeFi projects are built on blockchain technology, they provide a tamper-proof record of all transactions that can be easily audited and verified.

This can make it easier for accounting professionals to track and report on financial transactions, and may ultimately lead to a reduction in the risk of fraud and errors.

- More secure than our current traditional banking structure

DeFi applications offer improved security to accounting professionals by enabling them to track their assets and activity on the blockchain.

This transparency and immutability of data help to mitigate the risk of fraud and errors and provide a higher level of assurance to users that their accounting is accurate.

- Real-time settlements make it blazingly fast

By being able to settle transactions immediately, users can avoid the hassle and delay of traditional financial institutions.

This speed and convenience is a major advantage of DeFi, and is one of the reasons why it is growing in popularity.

- Crystal clear traceability on the public ledger

Decentralized Finance enhances the traceability of accounts by allowing users to track their account activity on a public ledger.

This transparency allows users to see where their money is going and makes it more difficult for fraudsters to hide their tracks.

- Inexpensive and Improved than Traditional

One of the most significant advantages of DeFi is that it uses cryptocurrency instead of fiat currency. This allows DeFi platforms to offer lower fees and faster transaction times.

In addition, DeFi is not subject to the same regulations as traditional financial institutions, which gives it the potential to offer even more innovative and efficient services to professionals.

- Low maintenance

To enjoy DeFi Services, you only need a crypto wallet and a good internet connection.

Accounting professionals can manage their finances within no time, without waiting for bank transfers and paying those hefty bank fees.

Although DeFi transactions may attract gas fees.

(Gas Fees: Fees charged by developers to process the transaction on the Ethereum blockchain.)

- Create New Opportunities

DeFi has the potential to create new opportunities for accounting professionals to provide assurance services, such as auditing DeFi projects or providing guidance on how to comply with regulatory requirements.

Shortcomings of DeFi

There is no second thought that decentralized finance has a lot of potential for accounting professionals.

However, there are also some shortcomings that need to be considered.

- Room for Improvement

DeFi is still in its nascent stage and has a lot of potential.

There is a lack of experience and understanding among accounting professionals on how to treat DeFi assets and transactions for accounting and tax purposes.

There are many DeFi projects and protocols being developed in the space, but it is still very new and there is a lot of uncertainty.

- Volatility

DeFi assets can be highly volatile, which can make it challenging for accounting professionals to accurately value and report on them.

This can create risks for accounting firms that may be asked to audit DeFi projects or provide assurance services.

- Lack of Consumer Safeguard

One of the major drawbacks of DeFi is that there is no consumer protection.

While using a DeFi platform if something goes wrong, you may not be able to get your money back.

In 2021, for instance, more than $10 billion was lost to DeFi scams (according to research from Elliptic, a blockchain analytics firm).

This is a risk that you need to be aware of before you use any DeFi platform.

- Vulnerabilities in Smart Contract

Hackers are a threat in DeFi because they can exploit vulnerabilities in smart contracts to steal funds.

They can also attack exchanges and wallets to harvest user information and passwords.

In addition to this, if there is the slightest bug in the code of a smart contract then it might lead to a loss of funds.

Overall, while DeFi presents some unique challenges for accounting professionals, it also offers the opportunity to be at the forefront of the development of a new financial system that is more transparent, accountable, and efficient. As such, it is important for accounting professionals to stay informed about DeFi and be prepared to adapt to the changes it brings.